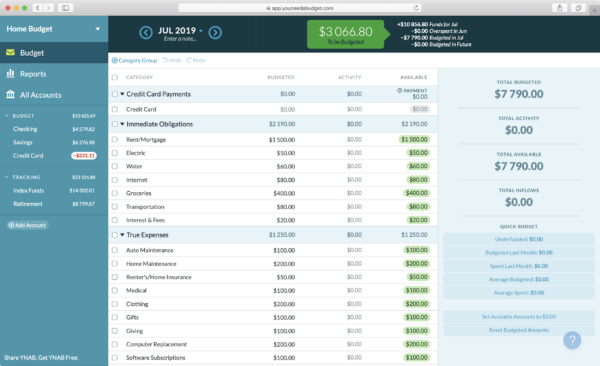

If the developer doesn't mind - can you post some improvements to the software written in plain english? I thought the tutorial was okay but if they go into greater detail it would be helpful. My biggest challenge was simply starting the process. I wasnt sure how exact my current balance should be. Should it be all money estimated (ours changes due to commission) coming in a for a month. YNAB Style Spreadsheet (from a Redditor on Reddit.com) As the name suggests, this spreadsheet’s layout and function is very similar to the paid budget software called YNAB (You Need a Budget). It’s perfect if you want to create a zero-based budget. The spreadsheet requires you to put in all of your transactions and categorize them.

Have you ever heard of You Need a Budget (YNAB)? YNAB is a budgeting tool created to help you have better control over your finances. It’s one of the most popular budgeting apps out there, but are there better YNAB alternatives?

Depending on your budgeting style, you might not find YNAB a good fit.

We’ll show you some similar software programs to help you decide which budgeting program will be best for you.

There are many reasons why budgeting is important, and these tools will help you to do it better.

In This Article

- Top YNAB Alternatives

Top YNAB Alternatives

There are a few different options you may want to check out if you’re looking for YNAB alternatives. Each one helps you reach your financial goals better, but they all work differently.

Here are some details on each of the five You Need a Budget alternatives we found.

1. Tiller Money

Tiller Money is an awesome YNAB alternative. It’s great for budgeting, expense tracking and deb payoff.

The main difference between Tiller and the other options on this list is that it uses Excel and Google spreadsheets.

When you sign up with Tiller Money, you link up your accounts, just as you do with YNAB. Next, you’ll create customized spreadsheets to help you manage your money, such as:

- Monthly budget spreadsheet

- Debt snowball spreadsheet (yes, it’ll help you get debt-free using the debt snowball method)

- Net worth tracker

- Weekly expense tracker

The worksheets are attractively designed and super easy to view and use. In fact, I signed up for Tiller a while back and am loving it. It’s thorough but easy enough for tech novices like me to use.

And it’s affordable. Tiller Money costs $79 a year. That averages out to $6.58 per month.

Read more about it in my full review of Tiller Money.

Automated Email Updates

Another great feature of Tiller Money is that it’ll send you an email every day. The email notifies you of any new transactions that occurred in your accounts in the previous 24 hours.

To me, this is a nice way to ensure you can catch any unauthorized transactions on your accounts early. And it’s nice to see how much money I spent the day before at a glance. All in all, the system is pretty thorough.

Tiller Money vs. YNAB

The main difference between Tiller Money and YNAB is the customization aspect. Tiller Money does a great job at creating great spreadsheets that are completely customizable.

And it’ll automatically update every spreadsheet you create. Bonus: Tiller Money is cheaper than YNAB by about $2 a month. That’s not a lot, but we budget-obsessed people know that it all adds up.

2. Personal Capital

Personal Capital will help you manage your money. However, it does so in a much more comprehensive way than YNAB. I’d say that Personal Capital is the best of the YNAB alternatives.

When you sign up with Personal Capital, you start by linking all of your financial accounts. You’ll include checking, savings, credit card, loan, retirement and investment accounts. Now you’ve got a complete picture of your entire financial situation in one place.

Next, you need to choose between the services Personal Capital offers. One is a free financial tracking service. The others are paid financial advisory, wealth management and private banking services.

Free Financial Tracking

The free financial tracking tools help you keep an eye on your overall financial situation. It’s nice because you don’t have to check each account manually online.

Instead, you just pull up your Personal Capital account and get a full view of your net worth and financial picture. This service is completely free.

That said, you will regularly get calls from advisers whose goal is to have you upgrade to a paid service. You may find these annoying. Just keep in mind that you are not required to upgrade. As long as you follow the terms and conditions, you can use the free service for as long as you want.

Paid Advisory Services

Personal Capital also offers to manage your investments, for a fee. If you sign up for paid services, you’ll get access to a team of financial advisers. There’s a $25,000 minimum investment for this service, which is higher than competitor websites. If you’ve got $200,000 or more, you’ll get two dedicated financial advisers.

As of this writing, the fees for investment services are as follows:

- 0.89% annually for the first $1 million

- 0.79% annually for $1 million to $3 million

- 0.69% annually for $3 million to $5 million

- 0.59% annually for $5 million to $10 million

- 0.49% for over $10 million

These are also higher than competitors’ fees. Wealthfront, SigFig and Betterment for example, charge 0.25% to 0.35%. But Personal Capital’s overall package is considered one of the most comprehensive in the field.

Personal Capital’s Free Tool vs. YNAB

The main difference between YNAB and the free Personal Capital tool is that the Personal Capital tracking tool gives you a long-term view.

With YNAB, you can manage your budget in line with your paycheck. It’ll help you manage your money for the current week, two-week period or month.

Personal Capital is able to give you a big-picture, long-term view of your money. This is because it includes retirement and other accounts. Also, it shows you how your retirement savings picture looks based on your current spending.

It pulls together current spending numbers, spending goals and more to help make sure you’re on track to save enough for retirement.

Plus, this version of Personal Capital is totally free. You’ll only pay if you decide to use their advisory services.

3. Mint

Mint was founded in 2006 and is currently owned by Intuit. It offers you a way to budget and track your money in one place. And it’s one of the most popular YNAB alternatives.

Like the other services listed here, Mint gives you easy access to your bank, credit card, investment and loan accounts all in one place.

It’ll also send you alerts if your bank account is running low or you have payments due on loans or credit cards. This is a nice feature because it helps ensure that you won’t accidentally forget to make a payment.

Late payments often result in late fees and raised interest rates. So in that way, Mint can help you save money.

In addition, Mint will let you know how much you’re paying in ATM and other fees. And it’ll alert you if there are any large or unusual transactions on your accounts.

Bonus: Mint helps you keep track of your net worth. It’s displayed at the top of your account every time you sign in.

Mint vs. YNAB

Both Mint and YNAB do a great job of helping you budget. Their interfaces and features are pretty similar.

However, Mint is completely free. There’s no charge to use it. That fact might leave you wondering how Mint makes money.

Mint makes money in a few ways:

- It offers various financial services to members, and it gets paid a referral fee if you sign up

- Mint has clickable ads on the site, which gives it the ability to bring in ad revenue

- You can sign up for premium access to your credit report with Mint, and it charges a fee for you to do that

Since the Mint and YNAB budgeting tools are pretty much equally great, the biggest reason Mint might be better for you is that it’s free. And free is good.

In addition, Mint has several additional features that YNAB doesn’t. It offers a more complete view of your finances and an alert system. Check out the Mint website for more information.

4. CountAbout

CountAbout was founded in 2012.

Its main goal is to be a step up from Quicken. In fact, you can seamlessly migrate from Quicken to CountAbout.

The site will automatically sync your Quicken data into the CountAbout system. One nice thing about CountAbout is that you can rename spending categories as you see fit.

CountAbout’s prices are also very reasonable. It costs $9.99 per year for the basic budgeting plan.

If you’re willing to upgrade to the premium plan, you’ll get an added benefit: automatic download of transactions. The premium plan is only $39.99 per year. That equates to a bit over $3 a month.

Along with budgeting tools, CountAbout also provides:

- Graphs to help you assess income and spending

- Ways to incorporate recurring transactions and split transactions

- Apps for Android and iOS

It’s a fairly thorough system that should meet the needs of most basic budgeters.

CountAbout vs. YNAB

The only big difference between CountAbout and YNAB is that YNAB allows investment tracking and CountAbout doesn’t.

And of course, CountAbout is cheaper, even if you do choose to sign up for the premium program.

5. EveryDollar

EveryDollar is the budgeting brainchild of well-known personal finance expert Dave Ramsey. The website says it’ll help you create your first budget in less than 10 minutes. It’s a simple program that’s fairly easy to use for people of almost any technical skill level.

EveryDollar has a free version where you can add income, spending and budgeting information manually.

It also has a premium version called EveryDollar Plus. This version costs $99 per year ($8.25 a month) and gives you the convenient benefit of automatic downloads for your transactions.

EveryDollar vs. YNAB

There are a few differences between EveryDollar and YNAB. YNAB has investment tracking and bill management, whereas EveryDollar does not.

On the other hand, EveryDollar has tax reporting capabilities. YNAB does not.

In addition, EveryDollar is available in the U.S. and Canada, while YNAB is only available in the U.S.

Related Post: Alternatives to the Level Money App

6. Goodbudget

Goodbudget is a budgeting app that helps you determine the “why” behind your expenditures. In other words, it helps you create a value-based spending plan.

It’s based on the cash envelope system and gives you electronic envelopes to put your spending money in when you create your budget.

You can sync your device with your partner too, so that you’re working your budget together. The free version of Goodbudget includes 10 e-envelopes, and works with one account for up to two devices.

The Plus version includes unlimited e-envelopes, unlimited accounts, lets you partner on five devices and more.

Goodbudget vs YNAB

Goodbudget and YNAB are alike in that they both utilize an electronic version of the cash envelope system. The one downside to Goodbudget is that it can’t sync up with your bank. That means all transactions have to be done manually.

However, you can download your bank statements into a supported system like Quicken and then import the info into Goodbudget.

7. PocketSmith

PocketSmith has been helping people budget since 2008. It touts itself as a budgeting app with unique features for every type of budget need, including those with multiple streams of income.

With PocketSmith, you can import your transactions from your bank using multiple bank accounts as long as they’re from the same bank. You can track your income, expenses, net worth and more.

You can make a cash flow forecast and work in multiple currencies too. PocketSmith has a free plan that allows you to budget and import transactions manually.

The Premium plan from PocketSmith is $9.95 per month or $7.50 per month if paid annually. This is their most popular plan. It allows for automatic or manual transaction importation, a 10-year financial projection and unlimited budgets.

PocketSmith’s SuperPlan allows for 30 years’ projection of your financial picture and costs $19.95 per month or $14.16 per month if paid annually.

PocketSmith vs. YNAB

PocketSmith and YNAB are a lot alike: they both offer budgeting, bill management and the ability to sync to your bank.

However, PocketSmith has a cashflow projection/forecasting feature that budget nerds like myself might find appealing. This makes PocketSmith one of my favorite YNAB alternatives.

8. PocketGuard

PocketGuard’s big push is that it allows you to know how much money is in your pocket at all times. You can use it to make a budget, monitor your spending, and remind you when bills are due.

By knowing what’s left in your “pocket” for the day, week, or month you can better make fluid spending decisions.

PocketGuard has a free version that allows for importing data from your bank and putting the data into preset categories.

PocketGuard Plus costs $3.99 per month or $34.99 per year when you pay annually. With PocketGuard Plus, you get added features like customized categories, unlimited goals, and more.

Ynab 4 Software 2017

PocketGuard vs YNAB

While PocketGuard is great for knowing how much you have to spend and for basic budgeting, YNAB still rules the roost for its attention to detail. The zero-based budgeting platform is great for the most detailed of budgeters.

9. Moneydance

Moneydance is a bit different from a lot of the other apps here in that it’s not cloud-based and it’s not really an app. Instead, it’s more like a Quicken alternative. It’s a software program that allows you to budget, import banking transactions and more.

It’ll help you see which bills are coming due and more. It costs $49.99 to purchase Moneydance as of this writing.

Moneydance vs. YNAB

The main difference between YNAB and Moneydance, is, of course, that Moneydance is a software program that keeps your information local, while YNAB is cloud-based.

That being said, you can save your YNAB locally–the app does have that option.

10. Wally

Wally is a free budgeting app that helps you set money goals and get insights on your spending. The downside with this and a lot of other free apps is that you have to input financial transactions in manually.

However, the app does offer the Wally Gold version, which will sync to your bank account and let you import transactions with bank-level security. As of this writing, Wally Gold was $19.99 for a lifetime subscription.

It’s available for both Android and iOS, and the Wally app will also let you store photos of receipts.

Wally vs. YNAB

Wally is pretty basic compared to YNAB, although the Gold version offers a lot more features than the free version. And reviewers say that it’s not quite as user-friendly as YNAB.

Add Wally to the long list of YNAB alternatives that could be a good choice for you. But YNAB is still among the top-rated budgeting apps.

Summary of YNAB Alternatives

Using a budgeting program like the ones we’ve mentioned here is important. It helps you avoid common budgeting mistakes that can have a long-term impact on your finances.

You Need a Budget (YNAB) is a popular budgeting tool that’s been around for a long time. It has a way of making budgeting more fun.

Bonus: The site has a light-hearted feel to it. Check out its “About” page for some laughs.

That being said, there are alternative budgeting options out there if you find YNAB isn’t working for you. Depending on what you need, one of the budgeting programs here is likely to suit you.

Have you ever used YNAB or any of the other programs we talked about? Share your thoughts about them on our social media accounts.

Check out these free budget spreadsheets and start telling your money where it should go!

Are you spreadsheet illiterate? Or worse….are you a spreadsheet fanatic? Do you pray at the altar of your budget or are you the type that can’t-keep-a-budget-to-save-your-life? Whichever way you rock it, you’ll find a budget spreadsheet (template) that works for you in the list below!

I fall into the category of “spreadsheet fanatic.” I loveeee me some spreadsheets (can you blame?…I’m an engineer!). If I’m in a situation that can be solved by creating a spreadsheet, my happiness level instantly doubles, probably triples if I’m telling the truth. I’ll find any excuse to create a spreadsheet.

This list below starts with the simplest, easiest spreadsheet that anybody can use. As the list goes on, the spreadsheets get more detailed, complicated, and are able to do more things.

1. Simple Budget (from Microsoft Corporation)

If you want to set the simplest budget possible (input income and set a value for spending for each budget category), then this your spreadsheet. All it does is add up all your income, add up your projected spending in each category, and calculate the difference of the two (which will tell you if you are making more than you spend, or vice-versa). This spreadsheet does not allow you to put in your expenses, so you can’t evaluate if you’ve stayed within your budget at the end of the month.

Ynab 4 Upgrade Tool

2. Personal Monthly Budget (from Microsoft Corporation)

Ugh, SSOOOOOO simple. And it prints on one page. Yes and yes. This spreadsheet is SOOOOO simple. It breaks your budget into several obvious categories (housing, transportation, loans, etc). At the beginning of the month you can enter the amount you project to spend. At the end of the month you can enter how much you actually spent. The spreadsheet will calculate the difference and also summarizes all the categories at the top and bottom. Best part, each monthly budget fits nicely onto ONE page, so it’s a clean and easily printable document. I love this. It does everythign you need. Perfect if you are just starting out. Perfect if you are looking for a printable document to put in your budget binder.

3. Budget Slasher (from Girls Just Wanna Have Funds)

This spreadsheet is set up just like a budget, but aims to help you slash your budget. It calculates how much your monthly savings will be if you follow your new, slashed budget. To get this spreadsheet, you have to go to the Girls Just Wanna Have Funds website, scroll down a little, click “Download Now” when you see the Budget Slasher spreadsheet, put in your name and email, and it’ll download the spreadsheet on your computer and open in Google Documents so you can download on your computer.

4. Monthly Budget Spreadsheet (from Money Under 30)

This first tab of the spreadsheet is your run-of-the-mill budget. It breaks your budget into categories, and you can input your budget for each category. But the part I really like about htis spreadsheet is that there are an additional 12 tabs, one for each month of the year. In each monthly tab, you can enter how much you spent in a budget category on a specific day….and then the spreadsheet will calculate how much of your variable expense budget you have left. The only thing that would make this better is if it told you how much money you have left in each category.

5. Simple Monthly Budget (from Zero Based Budget HQ)

This is super simple. It’s different from the other spreadsheets because you can input the percentage of your income you want to allocate for each category instead of inputting the exact amount you want to allocate. For instance, if you want to give 10% of your income to charity, you just write 10%, instead of having to calculate the amount like $230.

6. The Super Easy Budget Form (from Trees Full of Money)

This budget spreadsheet exploded on Pinterest….and for good reason. This spreadsheet is helpful if you have debt because it tells you the “extra money” you have (the money you haven’t budgeted) that could go towards paying off debt.

7. YNAB Style Spreadsheet (from a Redditor on Reddit.com)

As the name suggests, this spreadsheet’s layout and function is very similar to the paid budget software called YNAB (You Need a Budget). It’s perfect if you want to create a zero-based budget. The spreadsheet requires you to put in all of your transactions and categorize them. It’s a very visually appealing spreadsheet and it nicely summarizes each months’ available budget, income, and expenditures.

8. Updated Personal Finance Tracker (from a Redditor on Reddit.com)

This spreadsheet has the basics – a monthly budget (I like this because it has all 12 months in one tab, and it allows your budget to change from month to month) and a transactions log to record all your spending. But it also includes some extras – a savings balance sheet and a net worth tracker (and associated charts). This spreadsheet is great if you have some experience with excel, if your budget changes from month to month, and if you want a spreadsheet that has more than just a budgeting capability.

How do you keep track of your budget? Is it from a spreadsheet template like the ones above, using a digital program, or good old fashioned pen and paper?